Page contents

Pay Statements Explained - Frontline (Effective July 1, 2025) Link to this section

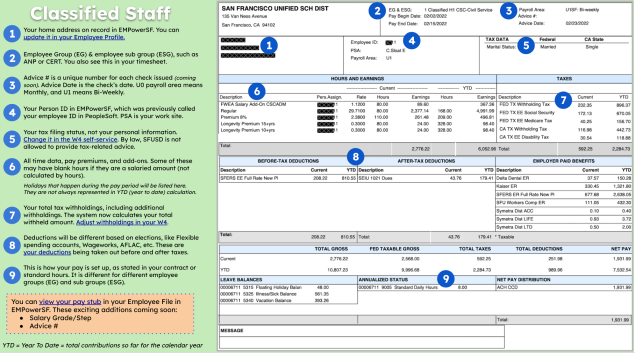

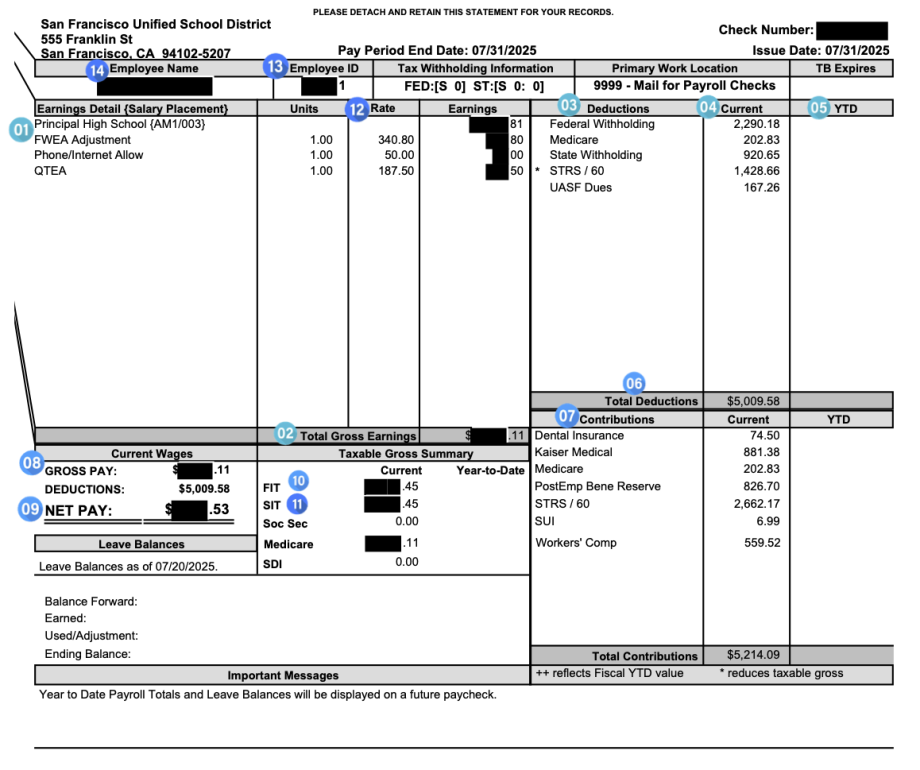

Here's an example of your new pay stub. The numbered key defines each section, allowing you to compare it to your old pay stub, below.

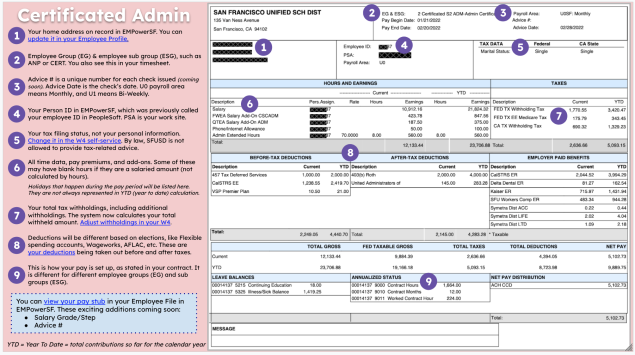

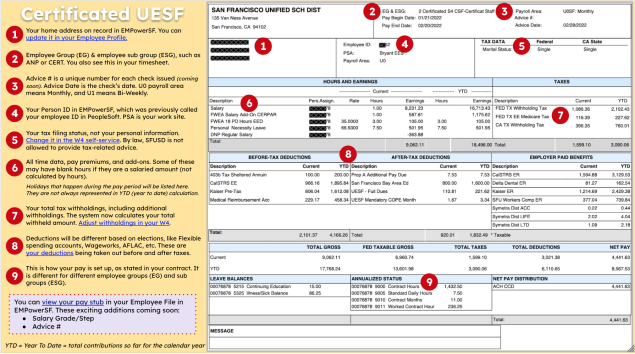

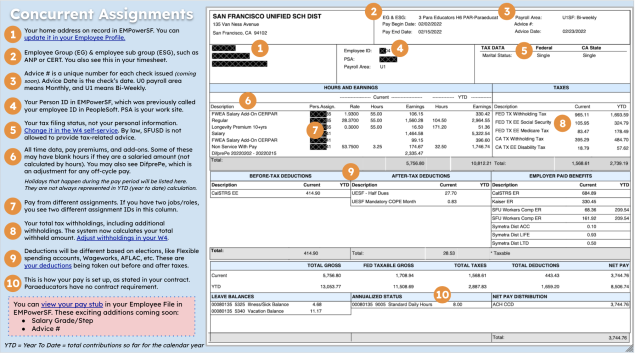

| 1. Earnings detail and salary placement. Time data, pay premiums and add-ons. Note: Salary line will include: paid holidays and paid absences. 2. Total Gross Earnings 3. Employee Deductions: subtractions from your gross pay (total earnings) that contribute to your net pay (take-home pay). 4. Current amount of Employee Deductions 5. Year to Date total of Employee Deductions 6. Total Employee Deductions for this paycheck 7. Employer Paid Contributions (this amount is not deducted from your check) | 8. Gross Pay: total amount earned before any deductions 9. Net Pay: total amount paid after employee deductions 10. Federal Income Tax: The amount that the Federal Government considers taxable based on your earnings 11. State Income Tax: The amount the state government considers taxable based on your earnings 12. Rate of Earnings 13. Employee ID 14. Employee Name and Address |

Certificated Administrator Check Sample (Using the same key as above):

Pay Statements Explained - EMPowerSF Link to this section

New: How to Read the Pay Stub (Four-Part Video Series) Link to this section

Certificated Staff: Explaining DNP & Adjustment Line

Link to this section

What is DNP (Deferred Net Pay)?

As a certificated employee at SFUSD, you are familiar with the varying number of work days in each month. For example, a school-term employee like a speech therapist could have the following work days distributed across the fiscal year:

|

Month |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

|

Days |

0 |

16 |

21 |

21 |

15 |

14 |

18 |

18 |

20 |

20 |

20 |

8 |

0 |

In this example, without a Deferred Net Pay (DNP) plan, an employee would receive $0 in July and would receive a much higher paycheck in March than June due to the number of days worked.

To allow for more consistency in earnings, SFUSD employs a Deferred Net Pay (DNP) plan. The DNP plan calculates the annual salary earned for days worked and pays it out in 12 equal monthly installments over the year, regardless of how many days you work in any given month. Beginning in February 2023, in addition to base salary, the DNP withholding calculation will also take salary add-ons into account to provide as much consistency in pay as possible on a month-to-month basis.

SFUSD uses DNP because of the unique way certificated employees are paid in California. Wages are only earned on the days that you actually work or use Sick Leave. Spring, Winter, and Summer Breaks, as well as weekends and holidays, are not paid days. DNP does not change the annual amount paid to employees; it only evens out the employee’s paycheck over the year.

Additionally, the retirement contributions to the California State Teachers Retirement Systems (CalSTRS) are also split equally over your 12 monthly paychecks each year. However, CalSTRS requires that earnings are reported for months in which work was performed. For SFUSD employees who work a regular TK-12 school year, this means that earnings can only be reported during the 11 months from August through June.

In order to accurately report service credits for retirement purposes and provide employees with both predictable paychecks, the District reached an agreement with UASF and UESF to institute this “Deferred Net Pay (DNP)” model that is widely used by county offices of education and districts across the state.

Importantly, due to DNP, a pay statement shows your monthly salary utilizing the Deferred Net Pay calculation, rather than actual earnings from any given pay period. Total year-to-date earnings are not visible until after you receive your final paycheck of the fiscal year. For most certificated staff, that is on Jul. 30 of each year. At that time, you know that you have earned and been paid your annual salary amount for the school year.

Historical Transition of DNP

January to June 2022

Beginning with your first monthly paycheck in January 2022, your salary rate displayed a new monthly rate. This rate was derived by taking your Annual Salary Amount less Paid Out Salary from August to December, and dividing it by the number of remaining working months, i.e. $95,213.00 - $39,672.00 = $55,541.00, then divided by 6 = $9,256.83. More than likely, this new rate was higher than your December 2021 rate. This was your rate for January to June 2022 only.

The item “DNP Regular Salary” with a negative amount was on your pay statements from January to June 2022. This was the calculated amount that was being set aside from each paycheck until June 2022. The accumulation of this DNP was paid out as compensation in the July 2022 pay period. The calculation of the DNP was derived from your Remaining Contract Salary x .006944, i.e. $55,541 x .006944 = $385.70. This was displayed as a negative earning on your pay statement.

Please know this was not an error, nor a function of the EMPowerSF miscalculating wages. This is how payroll was designed to accurately report CalSTRs deductions and to provide for a smooth monthly net pay to improve predictability of income for employees.

August 2022 to January 2023

When you returned from summer break and began your new contract with SFUSD in August 2022, your monthly rate was determined differently from the previous payroll system. Your new monthly rate was derived from your Annual Rate divided by the number of working months of your schedule.

This was more of a change for employees whose work calendar was August 2022 to January 2023. The 11-month schedule was used to calculate your monthly rate, i.e. $95,213.00 / 11 = $8,655.72. This was your monthly rate from August 2022 to January 2023. Your DNP withholding was calculated based on your Annual Rate, i.e. $95,213.00 * 0.006944 = $661.16. This DNP amount was set aside in order to provide compensation during your non-working July pay period. This DNP payout was your net pay for that period. As you can refer to the chart below, you can see how one’s pay is calculated and how DNP is paid out.

February 2023 to June 2023

Beginning in February 2023 (Pay Period 02 for Monthly and Pay Period 04 for Bi-Weekly), the Salary Add-On DNP will be calculated using the same formula as the Salary Base DNP. The amount that would have been collected between August 2022 to January 2023 and the amount that should be collected in February 2023 to June 2023 will be calculated, and the total will be divided among the remaining pay periods of the fiscal year. This new monthly DNP withholding for Salary Add-Ons will be added to the existing DNP line on the pay statement. This will result in a decrease in take-home pay for employees from February through June. The full DNP withholding, that now includes both the base salary and salary add-ons, will be paid out in July 2023.

SFUSD is planning with UESF to redesign DNP for school year 2023-2024 to incorporate feedback from UESF and ensure we continue to honor our labor commitments.

What is the adjustment line?

There are non-work days recorded on the timesheet that have to be represented in the pay statement but is already part of your annualized Salary. The “adjustment” line was implemented in April of 2022 to reflect time entered during the pay period that is not regular work hours. Examples are: Sick Leave, Personal Necessity Leave, Permission Days, Missed Contract Hours/Unpaid Scheduled Time, and Staff Development Days. It provides a way to show a consistent monthly gross pay in the “Salary” line and then shows changes to that pay based on the type of time you have taken that is different from a “Work” paycode day during the pay period.

When Certificated employees use paid time off during a pay period such as sick leave or personal necessity leave, you’ll see the number of hours you used followed by an adjustment subtracting the exact same amount of money (hence the negative amount). The salary amount used to do this automatically behind the scenes (from January 2022 - March 2022); it reduced itself by the amount being paid for time off to avoid duplicate pay. But now, the adjustment has been separated out to make it easier to understand and track the pay statement. The salary line should stay the same each month. There is not necessarily an error in your pay when you have an adjustment, unless you missed contracted hours.

How do I...

Link to this section

Access my old pay stubs before January 2022?

Pay stubs issued prior to December 31st, 2021 will continue to be available at http://stubs.sfusd.edu/.

If you have retired or resigned, please email help@sfusd.edu.

Access my current pay stubs (from January 2022 to the most recent)?

- Login to EMPowerSF using your SFUSD email and password

- Click ‘Home’ to display the dropdown menu

- Click ‘My Employee File’ from the dropdown menu

- Click the down arrow on ‘Payment Information’ to display the dropdown menu

- Click ‘Payroll Information’ from the dropdown menu

- Click ‘Pay Statement’ in blue text to display your pay stub

Watch the video here:

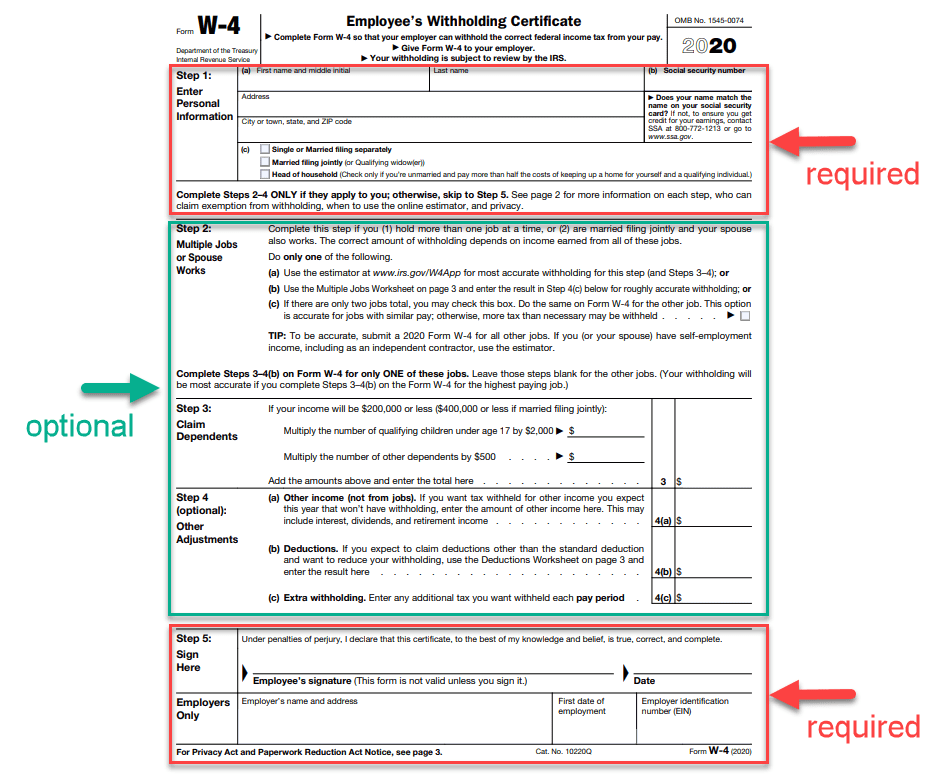

Update my W-4?

The 2017 Tax Cuts and Jobs Act overhauled a lot of tax rules, including doing away with personal exemptions. That prompted the IRS to change the W-4 form. A W-4 form, or "Employee's Withholding Certificate," is an IRS form employees use to tell employers how much tax to withhold from each paycheck. SFUSD uses the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees.

The new W-4, introduced in 2020, still asks for basic personal information but no longer asks for a number of allowances. This form DOES NOT exist in our current employee information system, PeopleSoft, and our new platform only has the updated one for the IRS (as it should).

As an SFUSD employee, you will use EMPowerSF to enter your W-4 information in January.

Do I really need to do it right after go-live?

No. You can do this update at your convenience

Need support?

SFUSD is not legally allowed to provide tax support. There is an estimator worksheet in the IRS Form W-4 instructions to help you compute certain tax deductions you might have coming. For technical support on how to use EMPowerSF to update your tax forms, please follow the instructions here.

Recommended Search Terms

This page was last updated on August 19, 2025